Solar technology’s rapid rise

The sun is one of our closest allies in the fight against climate change. The International Renewable Energy Agency (IRENA) claims that faster deployment of photovoltaic (PV) technology could herald a 21% reduction in global CO2 emissions by 2050.

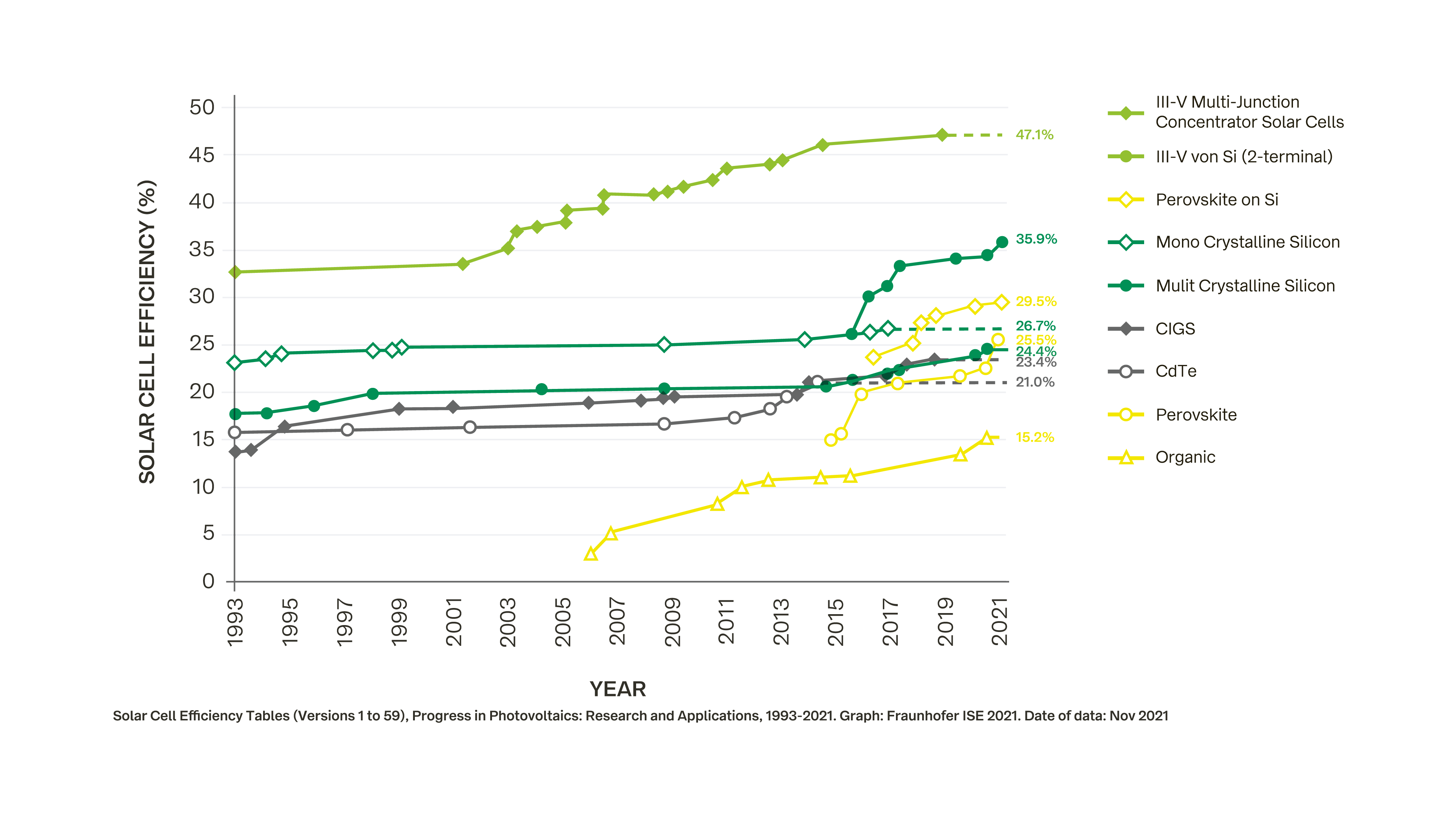

This technology is advancing fast according to the Fraunhofer Institute for Solar Energy Systems’ photovoltaics report:

- The efficiency of commercial wafer-based silicon modules increased from 15% to over 20% in the last 10 years

- Cadmium telluride (CdTe) modules increased from 9% to 19%

- High-concentration multi-junction solar cells achieved an efficiency of up to 47.1% in a lab setting

Of course, PV assets need to be in peak condition to produce these kinds of results. Aged and outdated systems risk technical and operational issues. That means business downtime and financial losses. Repowering or revamping the technology used in solar parks makes all the difference:

- Asset performance improves

- Operational and maintenance costs are reduced

- Integration with the latest technology becomes possible

- Asset lifespan increases, along with ROI

It’s time to talk about repowering

In fact, some big module and inverter companies like Swiss ABB and US LG Electronics have quit the market entirely. This leaves owners who don’t repower or revamp their assets in a precarious situation.

This paper explores the growing repowering and revamping market for ground-mounted solar PV assets. We’ll also discuss the many benefits that come from keeping your solar park in peak operating condition.

What does the market say?

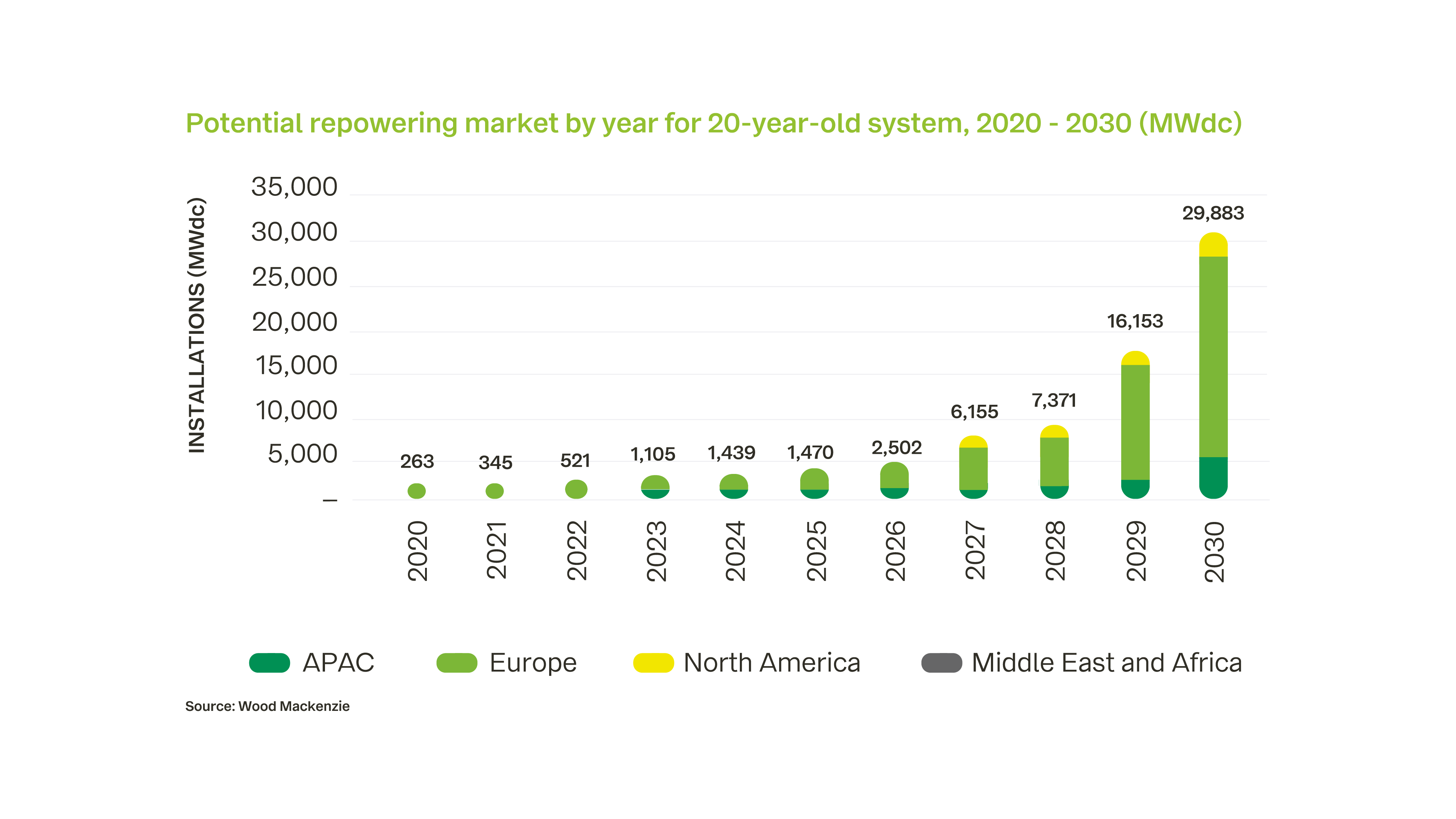

Solar power itself is, in the grand scheme of things, a relatively new industry. Replacing faulty equipment has mostly fallen under routine O&M, but that’s all about to change. Worldwide, more than 67GW of solar capacity will reach 20 years old in the 2020s. Most of that is in Europe, where many pre-2013 plants were rushed to meet feed-in tariff deadlines.

That presents significant opportunity for repowering as those installations reach the end of their warranties and subsidy periods. Researchers Wood Mackenzie predict repowering to be one of three main themes underpinning the market’s next decade. 29,883MWdc of potential could exist around the world by 2030.

There are obstacles standing in the way of that boom. Legislation needs to catch up in some countries. France imposes a 10% cap on capacity increase from repowering, compared to Italy’s 1%.

Despite this, Europe is set to lead the way over the coming decade. The UK, Germany, Italy, Spain and France are the biggest repowering markets today.